The Four Games in the Casino

And Why We Choose Pain

Welcome back to the lab.

If you spend five minutes on Prediction Market Twitter, you’ll notice a pattern. Everyone is posting PnL screenshots, but they are playing completely different sports on the same field.

To survive here, you need to know which game you are playing. If you try to mix them, you are just liquidity for someone else.

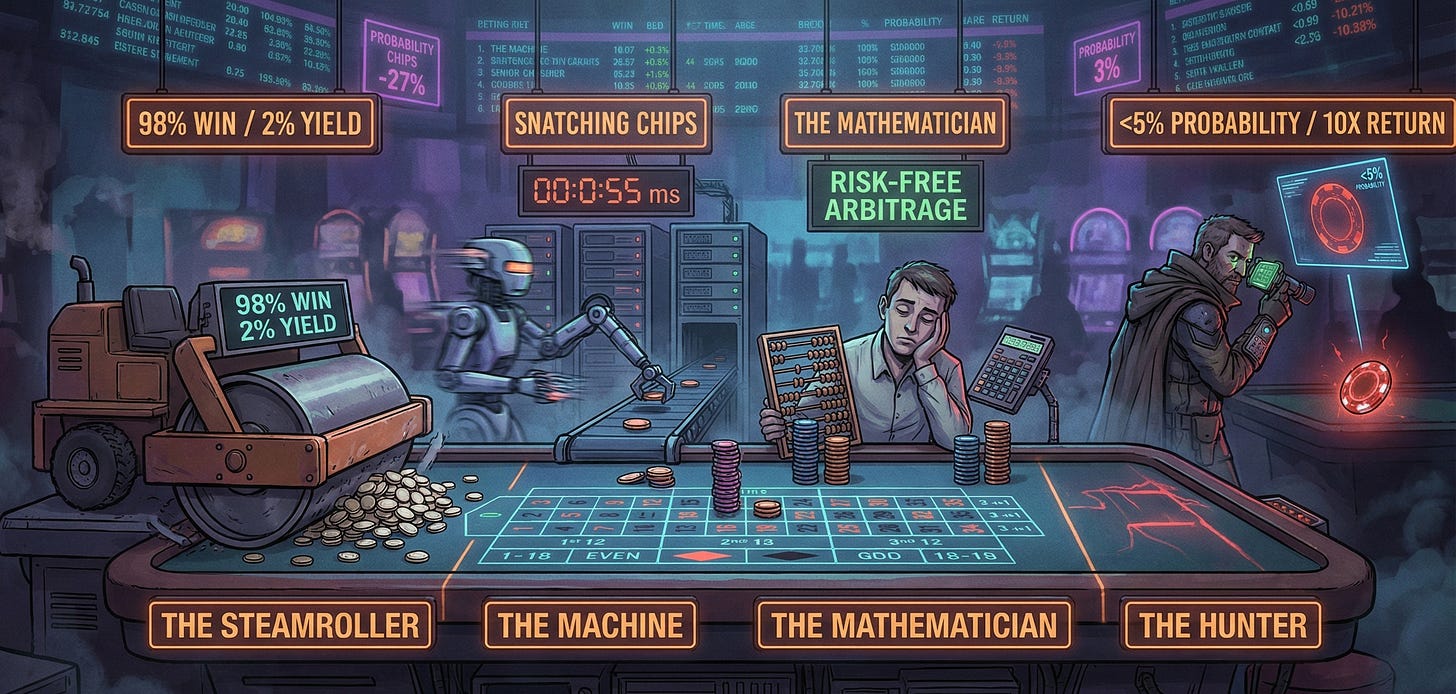

Let’s break down the four archetypes you’ll see in the wild, ranked by Effort, Reward, and Emotional Pain.

Game 1: The Steamroller (The “Sure Thing”)

The Vibe: “Free money! Just bet ‘No’ on nuclear war!”

The Play: Betting max size on “Sure Things” (98% probability) to squeeze out a 2% return.

Effort: Low.

The Trap: You feel like a genius for 6 months. Then, one “impossible” event happens (a court ruling flips, a crypto ETF gets delayed), and you are wiped out.

Verdict: The Trap Door. We don’t play this. Picking up pennies in front of a steamroller is not a strategy; it’s a suicide pact.

Game 2: The Machine (The Speed Bot)

The Vibe: “I just printed 50% in 15 seconds.”

The Play: These aren’t predicting outcomes; they are predicting latency.

The Reality: Bots monitor Binance prices and snipe Polymarket order books that are lagging by 30 seconds. They win 99% of the time.

Verdict: Respect. But unless you have institutional-grade code and servers, do not try to beat these guys at a speed game. You will lose.

Game 3: The Mathematician (The House)

The Vibe: “I don’t care who wins, I just want the spread.”

The Play: This is risk-free Arbitrage. You exploit the broken math of the crowd.

Scenario A: The “Dopamine Premium” (Sum > 100%)

The Logic: Retail traders love betting “Yes.” In a 5-candidate election, fanbases often bid up every candidate until the total probability equals 120% ($1.20).

The Move: You bet “No” on everyone. You effectively become the Casino, collecting the $1.20 premium to pay out the $1.00 winner. You pocket the 20¢ risk-free.

Scenario B: The “Neglect Gap” (Sum < 100%)

The Logic: In boring, un-hyped markets, liquidity dries up. You might find a market where Option A (40¢) + Option B (30¢) + Option C (20¢) only equals 90¢.

The Move: You buy “Yes” on all three. You pay 90¢ for a guaranteed $1.00 payout.

Verdict: Safe, but Boring. This is a great way to grind out steady yields, but it requires massive capital efficiency. We respect it, but we aren’t here for 5% yields.

Game 4: The Hunter (Our Game)

The Vibe: “I lost money for three weeks straight, and today I made 10x.”

The Play: We hunt Outliers. We look for events priced at 2¢ that the data says are worth 15¢. We borrow our philosophy from Venture Capital: we accept a low win rate in exchange for massive asymmetry.

Effort: Medium (Research & Patience).

Emotional Pain: High.

The Reality: This strategy hurts. You will be wrong often. You will watch your account bleed slowly on small bets that go to zero. It is inconvenient and sometimes it takes a long time to find a suitable trade.

The Reward: You only need to be right once to pay for a year of losses. We are looking for the Sharpe Reversal—the moment the market is dead wrong about a tail event.

Verdict: The Goal. This is the only game where a human with a brain still has an edge over a bot.

The Math of Pain (Why We Accept a 30% Win Rate)

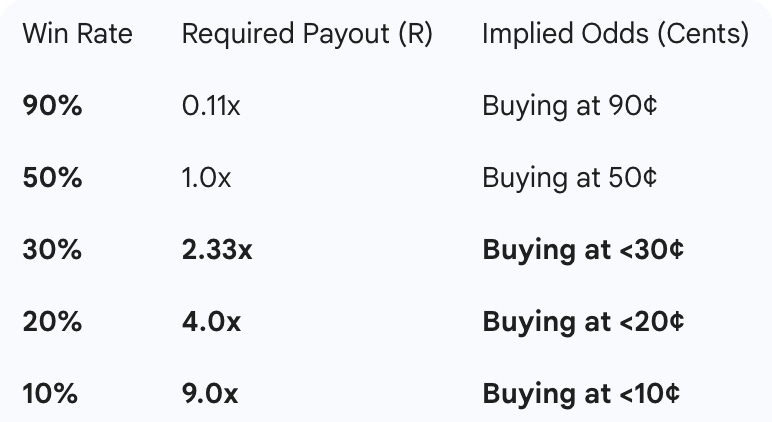

New traders obsess over being “right.” They want a 90% Win Rate. Hunters obsess over Expectancy. We are okay being wrong 70% of the time, provided the math is on our side.

In prediction markets, we rarely know the “True Probability” (anyone who claims to is lying). But we do know the Payout.

If you are going to play Game 4, you need to internalize this table. This is the minimum multiple (Reward) you need just to break even, based on your Win Rate.

The “Hunter’s Rule”: Since we assume we will be wrong roughly 70% of the time (a 30% win rate), we never enter a trade unless it offers at least a 3x return potential (300%).

This is why we never touch the “90¢ to $1.00” trade.

The Trap: If you buy “Yes” at 90¢, you are risking 90¢ to make 10¢.

The Math: You need a 92% win rate just to break even (after fees/slippage).

The Reality: If one “Sure Thing” blows up (and they always do), it wipes out the profit from your last 20 winning trades.

We live in the bottom half of that table. We look for assets trading between 2¢ and 15¢ that have a realistic path to 50¢. We don’t need them to go to $1.00. If we buy at 5¢ and sell at 25¢ on a volatility spike, we just made 5x.

How We Hunt (The Human Edge)

Since we can’t beat Game 2 (Speed) and we refuse to play Game 1 (Steamroller), how do we find these 5x plays? We look for the moments where the crowd gets emotional, lazy, or panicked.

1. The “New Market” Golden Window

When a fresh market drops, liquidity is low and the “Narrative” hasn’t formed yet.

The Alpha: The crowd hasn’t arrived to ape into the “obvious” choice. This is the only time you get fair odds before the herd creates a price distortion.

Real World Proof: When Sam Altman was fired from OpenAI, the “Will he return?” market opened with extreme volatility. Early panic sellers dumped “Yes” shares to <10¢. Hunters who realized the board battle wasn’t over bought those shares and rode them to $1.00 when he was reinstated days later. (10x Return).

2. The “Zombie” Play (Dead Cat Bounce)

This is the ultimate Hunter setup.

The Setup: A candidate drops out, or a regulatory ruling looks bad. The market panics and sells the “Yes” shares down to pennies. The crowd assumes it’s dead.

Real World Proof: In March 2024, the crowd decided the Ethereum ETF was dead. Odds crashed to 28¢. The “Vibes” were terrible. But the legal data said the SEC was cornered. When the SEC suddenly pivoted in May, those 28¢ shares ripped to 99¢ in 48 hours. (3.5x Return).

The Move: We buy the “Dead” asset when the math says there is still a pulse. If we are wrong, we lose 1¢. If we are right, we make 10x.

3. The “Two-Minute Drill” (Expiring Volatility)

The Context: Live events (Super Bowl, Debates, Election Night) where the market expires in minutes.

The Alpha: As the clock ticks down, Gamma (volatility) explodes. The crowd over-adjusts to every small move.

The Move: We look for the “Hail Mary.” If a team is down by 3 points with 2 minutes left, the market might price them at 5%. But in the NFL, a last-minute drive happens ~20% of the time. We buy the “Loser” for pennies and sell into the volatility of the final drive.

Summary

We are Professional Losers.

We don’t pick up pennies in front of steamrollers. We don’t try to out-sprint a high-frequency trading bot. And we don’t have the patience to grind out 2% arbitrage yields.

We wait in the bushes. We look for the moment the crowd gets distracted. And then we take the other side.

It’s painful. It’s volatile. But it’s the only place left for cavemen like us.

Sharpen your claws.

- Kimchi

Fascinating. Your breakdown of these market games feels like a great follow-up to your previous deep dives into complex systems. It's wild how folks optimise for such diffrent edge cases.